How EVs Work

Electric Vehicles 101

What Makes EVs Different?

In general, the public at-large does not have a good understanding of the differences between Plug-In Hybrid Electric Vehicles (PHEVs) and Battery Electric Vehicles (BEVs). Many consumers are not aware of the varying range of Electric Vehicles (EVs), the cost of EVs, how or when to charge an EV, or that an infrastructure for charging plug-in vehicles is growing fast.

Transforming Texas' Transportation Future

an educational film by Plug-In Texas

Some hybrid plug-in vehicles employ a generator that kicks in to replenish vehicle’s batteries when depleted. If driven within the range of the car’s batteries – anywhere from 40-100 miles, depending on the manufacturer – a plug-in hybrid vehicle’s electric motor is the sole source of its propulsion.

Most hybrid and all-electric vehicles also employ a form of regenerative braking, meaning that instead of the electric motor driving the wheels, the wheels drive the motor, which then functions as a generator, converting energy normally wasted into electricity that is stored in the car’s battery until needed.

The operation of EVs is not much different from a conventional vehicle: push the start button and go! The main difference, of course, is that instead of waiting in line to fill up their gas tank, EV drivers simply plug in their car to a standard 110-volt household outlet, or faster charging equipment which is available in the marketplace.

Purchasing an EV tends to be more complex than buying a gasoline-powered vehicle, largely because most consumers do not know how to accurately compare EVs to a car that runs on gasoline. To help address this problem, the U.S. Department of Energy (DOE) has created the eGallon tool (see details below), which allows consumers to compare how much they would save driving an EV, compared to a conventional gasoline-powered vehicle.

Many Texas utilities provide the opportunity for EV drivers to save more money by taking advantage of lower off-peak charging rates, and some even offer free electricity at night. Nighttime charging has the added benefit of tapping into electricity generated from the wind, which tends to blow harder during the night, when demand for electricity is otherwise low. As additional wind energy is added to the Texas power grid, EV drivers will further contribute to a system that produces fewer harmful emissions.

Comparing costs of EVs with gasoline-powered cars

Every driver knows what it costs to fill up the tank – it’s right there on the sign at every gas station. But for EV drivers, most of whom charge their car at home, there isn’t a similar measurement to determine the cost of driving an electric car. In response, the U.S. Department of Energy (DOE) created the eGallon.

| Regular Gasoline | eGallon | |

| Texas | $ 1.97 | $ 1.01 |

| U.S. Average | $ 2.20 | $ 1.16 |

For more on how eGallon is calculated:

Simply put, the eGallon represents the cost of fueling a vehicle with electricity compared to a similar vehicle that runs on gasoline. For example, if gasoline costs $2.60 a gallon in your state and the eGallon price for your state is $1.10 you could drive the same distance for $1.10 of electricity as you would for $2.60 worth of gasoline.

The DOE calculates how much electricity EVs require to travel the same distance as comparable models of gasoline-fueled vehicles would travel on a gallon of gasoline. That amount of electricity is then multiplied by the average cost of electricity for the state, giving consumers an apples-to-apples way to compare the cost of driving an EV vs. a comparably sized car that runs on gasoline.

What is the Market for Electric Cars?

While their overall market share remains small, the EV market is rapidly changing and growing fast.

There are still only about 400,000 electric vehicles on the road in the U.S. today but some estimates suggest sales of EVs could account for one-fifth of new car sales globally by 2025, with more bullish projections projecting EVs taking 50% of sales by 2030.

Bloomberg New Energy Finance projects growth rates could put EVs at more than one-third of new car sales globally by 2040. Meanwhile, as the cars and their batteries get cheaper, they’ll become more accessible to buyers.

According to the Texas Department of Motor Vehicles Texas Registered Vehicles Report by Fuel Type, there were 8,397 EVs in 2016 but Navigant Research’s Electric Vehicle Geographic Forecasts report estimates that number could grow to nearly 100,000 by 2023.

The timing of such an explosive growth in EV sales could coincide with a profusion of charging stations, which should go a long way toward addressing so-called “range anxiety,” the concern some drivers express over whether an EV will get them where they’re going without having to stop to recharge their car’s batteries. Still, since 78 percent of Americans drive 40 miles or less a day, and 90 percent drive 50 miles or less, an EV makes a lot of sense as a commuter car.

Virtually all of the major automakers, along with several start-up companies, have developed one or more plug-in vehicle. Ford, GM and Toyota all have long invested and produced plug-in electric vehicles models. All told, there are over 30 plug‐in vehicles for sale in the U.S.

According to a new analysis of the electric-vehicle market by Bloomberg New Energy Finance, battery prices fell 35 percent last year and are on a trajectory to make unsubsidized electric vehicles as affordable as their gasoline counterparts in the next six years. That could trigger a real mass-market liftoff for electric cars.

Current EV Prices

Most Popular EVs

$26,000 – $32,000

Plug-In Hybrid EVs

$30,000 – $75,000

The most popular electric and plug-in cars are sticker priced at $26,000 to $32,000 before a $7,500 federal tax credit. In many locations, leases are available for as little as $170 a month (after you sign the tax credit over to the leasing company). Plug-in hybrids list at between $30,000 and $75,000, and some are advertised with lease deals as low as $170 a month. Many states have incentive programs for light duty passenger and fleet vehicles to help offset the expense of these clean, advanced vehicles. The innovative Texas Emissions Reduction Plan, administered by The Texas Commission on Environmental Quality, manages a number of grant programs for Texans resulting in the reduction of harmful mobile source air emissions.

What About EV Chargers?

Electric cars achieve their biggest benefits when they’re charged overnight at home during off-peak hours when electricity rates are often lower. Many EV drivers cite the convenience of plugging in their cars at home as a strong preference to stopping at a gas station to fill up their tanks.

It’s easy to charge a plug-in hybrid overnight, even on a standard 110-volt household outlet. Fully depleted, pure electric-car batteries can take almost a full day to charge on such low power. Many EV owners purchase a 240-volt, Level 2 home charger, which sell for $400 to $700, depending mainly on amperage and the length of the cable, with installation costing an additional $300 to $500. Level 2 chargers allow EV owners to charge up their car batteries in less than half the time it takes from a standard wall outlet, as little as four hours for some EVs.

It’s easy to charge a plug-in hybrid overnight, even on a standard 110-volt household outlet.

Cities throughout the U.S., including several in Texas, are installing public chargers. In addition, an increasing number of retail outlets are providing free EV charging to their customers.

The global EV charging market has entered a transitional phase in expectation of the introduction of several new lines of plug-in electric vehicles from. Automakers are actively involved in infrastructure deployment, which is altering dynamics of the marketplace, and utilities are starting to play a significant role in the charging infrastructure landscape. For example, signs indicate a greater focus on the installation of charging units in multi-unit dwellings and workplaces.

In response, the global market for EV supply equipment is projected to grow from 425,000 units in 2016 to 2.5 million in 2025. For more on EV charging services, read a new report from Navigant Research.

2016

425,000 units

2025 Projection

2.5 million units

Yet another new and exciting development is research into wireless EV charging. Oak Ridge National Laboratory and Hyundai are working to demonstrate wireless charging on a variety of vehicles. The technology centers around a connection between a transmitting pad on the ground (such as in a garage) and a receiving pad on the bottom of the EV. The transmitting pad is connected to a 240-volt outlet, which generates a magnetic field. When the coil in the receiving pad is tuned to oscillate at the same frequency, the magnetic field generates a current in the receiving coil, charging the vehicle’s battery.

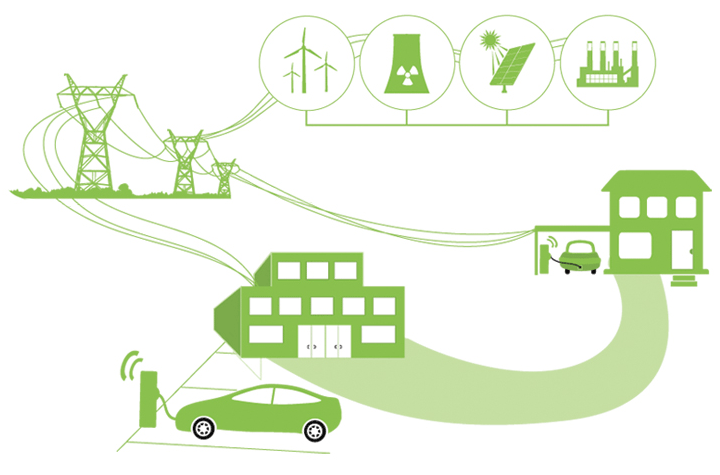

What Do EVs Mean for Electric Utilities?

Through smart grids technology that allows utilities to more effectively monitor transmission and distribution networks and digitally communicate with customers, plug-in vehicles have the potential to deliver energy stored in batteries back to the power grid. In turn, this would provide grid operators another important tool in balancing supply and demand for electricity, and maintaining system stability.

For example, a car with a 30 kWh battery stores as much electricity as the average U.S. residence consumes in a day.

Through the use of two-way advanced meters, vehicle-to-grid power flows would give utilities the ability to flexibly manage charging while still meeting customer requirements, in effect creating a new kind of distributed resource.

As a pooled resource, electric vehicle batteries in aggregate could provide a wide range of valuable grid services, from demand response and voltage regulation to distribution-level services, without compromising the customer’s driving experience or vehicle performance.

While only in its nascent stages, preliminary studies show strong potential for electric utility companies to use new communications and control technologies, together with innovative tariffs and incentive structures from utility regulators, to tap the value of smart electric-vehicle charging to wide range of stakeholders, from electricity customers, shareholders, EV owners, and society at large.

If utilities anticipate the load of charging EVs and plan for it proactively, they can not only accommodate the load at low cost, but also reap numerous benefits to the entire system.